Breaking Down REIT Expenses: Analyzing Costs with Front View REIT

Introduction: The Importance of Understanding REIT Costs

When analyzing a Real Estate Investment Trust (REIT), understanding its cost structure is crucial. In this article, we will focus solely on the types of costs and expenses associated with REITs, using Front View REIT as an example.

REIT costs generally fall into several categories, including acquisition costs, operating expenses, property management fees, financing costs, and administrative expenses. Each of these plays a role in shaping the REIT’s profitability and cash flow.

While this article focuses on costs, it’s important to remember that evaluating a REIT requires a broader approach. Other critical factors to consider include debt levels, operational efficiency, equity structure (common and preferred shares), and financial leverage. A comprehensive analysis of these elements provides a clearer picture of a REIT’s overall financial health and investment potential.

What are REITs

Real Estate Investment Trusts (REITs) provide investors with a way to access real estate markets without directly purchasing or managing properties. These companies own, operate, or finance income-generating real estate assets, offering investors returns primarily through dividend payments derived from rental income or interest on real estate loans.

Types of REITs and Their Cost Structures

REITs are categorized into different types based on their investment focus. Equity REITs primarily own and manage income-producing properties, generating revenue through rent collection. Mortgage REITs focus on real estate financing by investing in mortgages and mortgage-backed securities, earning income from interest payments. Hybrid REITs incorporate elements of both, investing in physical properties as well as real estate debt to create a diversified income stream.

The cost structure of a REIT depends largely on the type of REIT. Equity REITs typically incur higher operating and property management costs, while mortgage REITs face financing and interest-related expenses.

Key Cost Categories in a REIT

- Corporate Governance & Compliance Costs These include board compensation, directors’ and officers’ insurance, legal, audit, and tax expenses. These costs ensure that the REIT operates within regulatory frameworks, maintains transparency, and protects its executives from liability risks.

- Employee Compensation & Administrative Costs This category includes employee salaries, benefits, and general administrative expenses. These costs are essential for managing daily operations, overseeing properties, and ensuring smooth internal processes.

- Property Operating Costs These include maintenance, utilities, repairs, and other expenses required to keep properties functional. These costs fluctuate based on the number of properties owned and market conditions.

- Property & Asset Management Fees These cover fees paid to external or internal managers for overseeing property operations and managing assets. Property management fees are typically tied to occupancy rates, while asset management fees may be structured as a percentage of total assets.

- Transaction & One-Time Costs These include costs associated with acquiring, selling, or impairing properties, as well as consulting and legal fees for major transactions. While these costs are not recurring, they impact overall financial performance in specific periods.

- Insurance & Risk Management Costs This includes insurance policies that protect properties, executives, and corporate operations. These expenses help mitigate risks related to property damage, liability claims, and unforeseen business disruptions.

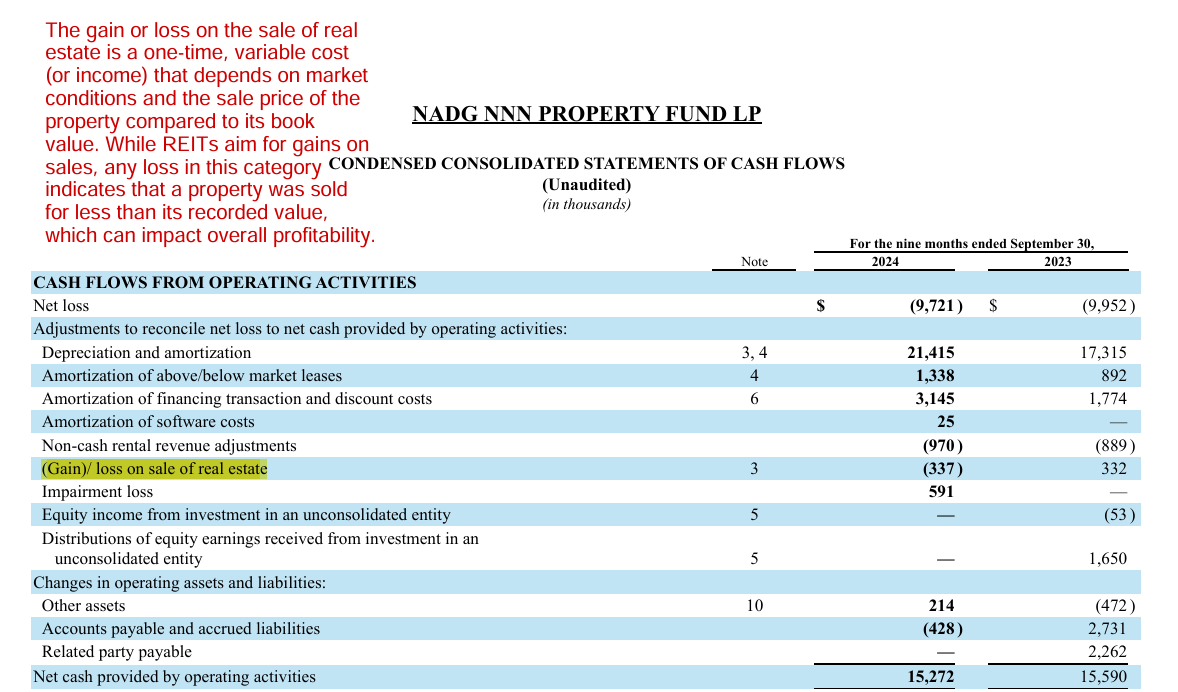

- Gains & Losses on Property Sales This represents the profit or loss from selling real estate assets. While REITs aim to generate gains from sales, any losses in this category could signal poor asset performance or unfavorable market conditions.

Fixed vs. Variable Costs

When analyzing the costs of a Real Estate Investment Trust (REIT), it is important to understand the difference between fixed and variable costs because it helps assess how expenses respond to market changes.

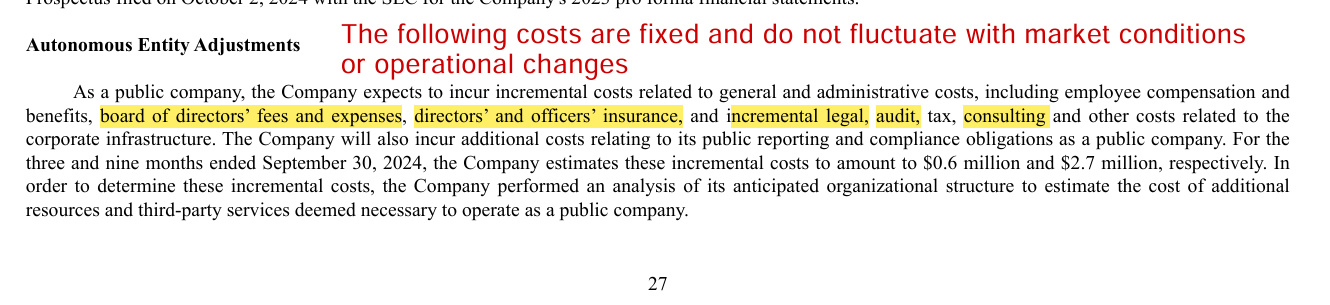

Fixed costs remain constant regardless of the REIT’s performance or the number of properties it owns. These expenses do not change significantly in the short term. Examples include board compensation, directors’ and officers’ insurance, legal and audit fees, consulting costs, and general corporate expenses. These costs are necessary for maintaining corporate operations, compliance, and governance, regardless of market conditions.

The following financial extracts from Front View REIT provide real-world examples of these cost structures.

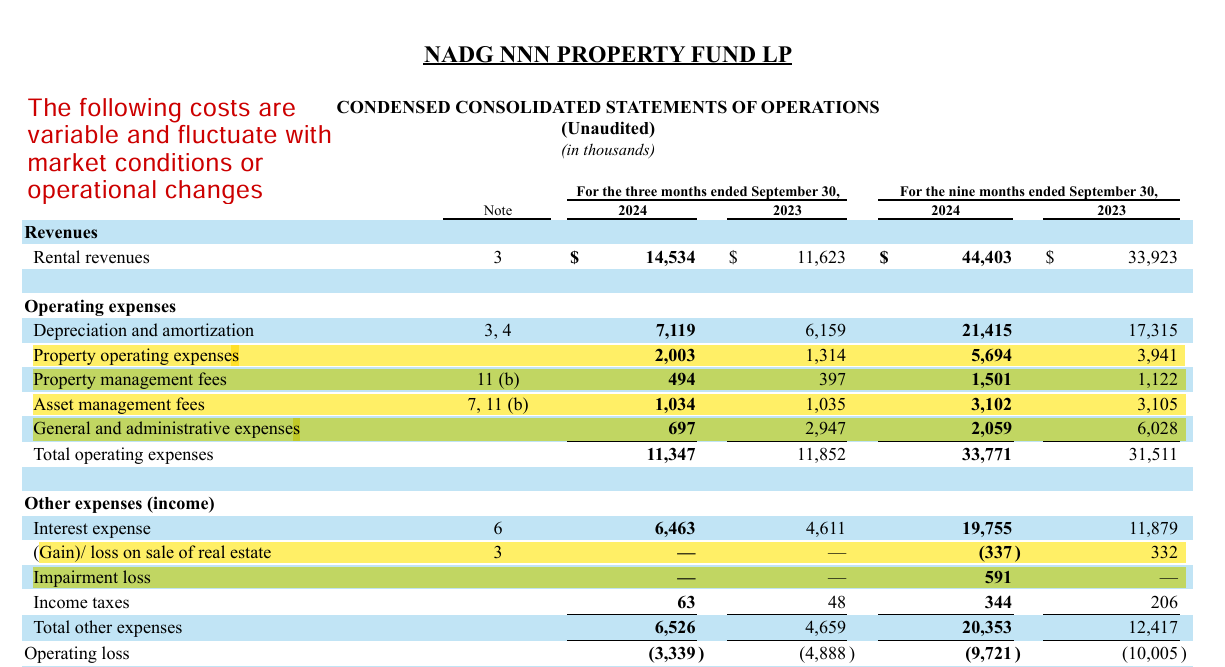

On the other hand, variable costs fluctuate based on the REIT’s activities, property portfolio, and market conditions. These include property operating expenses, property management fees, asset management fees, and impairment costs. For instance, property management fees and operating expenses increase as more properties are acquired or if maintenance costs rise. Similarly, gain (or loss) on the sale of real estate depends on market conditions and property transactions, making it unpredictable.

The following financial extracts from Front View REIT provide real-world examples of these cost structures.

Together, these fixed and variable costs shape a REIT’s overall expense structure. While fixed costs ensure the company’s corporate infrastructure remains intact, variable costs impact profitability based on operational efficiency and market performance.

Essential vs. Less Essential Costs

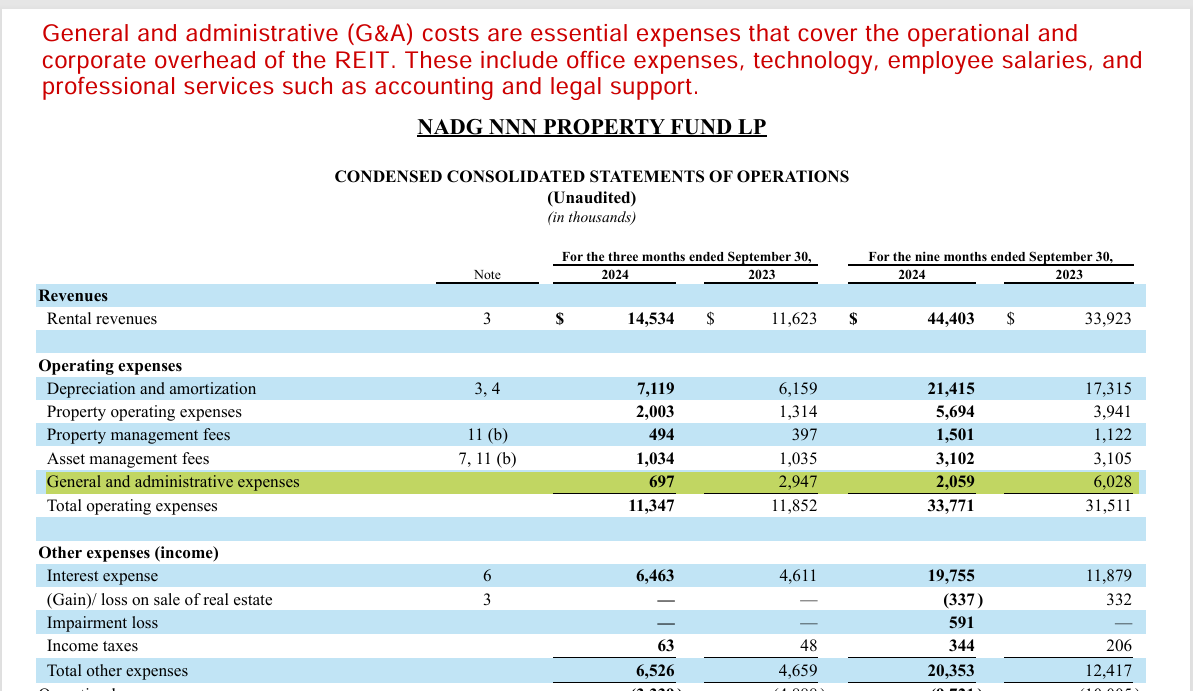

Some costs are essential because they are necessary for the REIT to function effectively and comply with legal, financial, and operational requirements. These include general and administrative costs, employee compensation and benefits, board compensation, legal and audit fees, directors’ and officers’ insurance, and property operating expenses. Without these expenses, the company would struggle to manage its properties, meet regulatory obligations, and maintain investor confidence.

The following financial extracts from Front View REIT provide real-world examples of these cost structures.

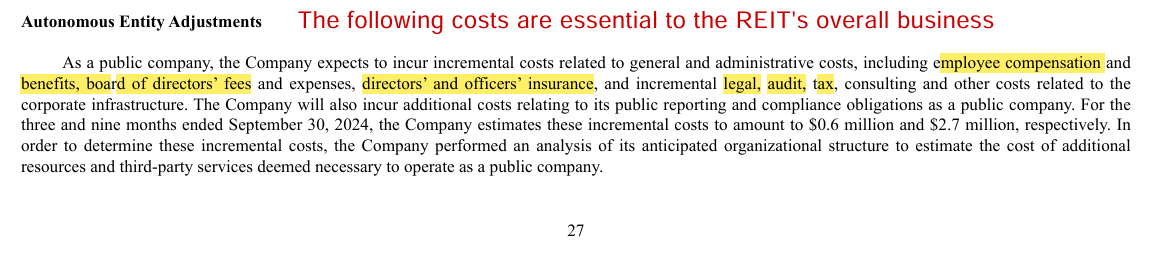

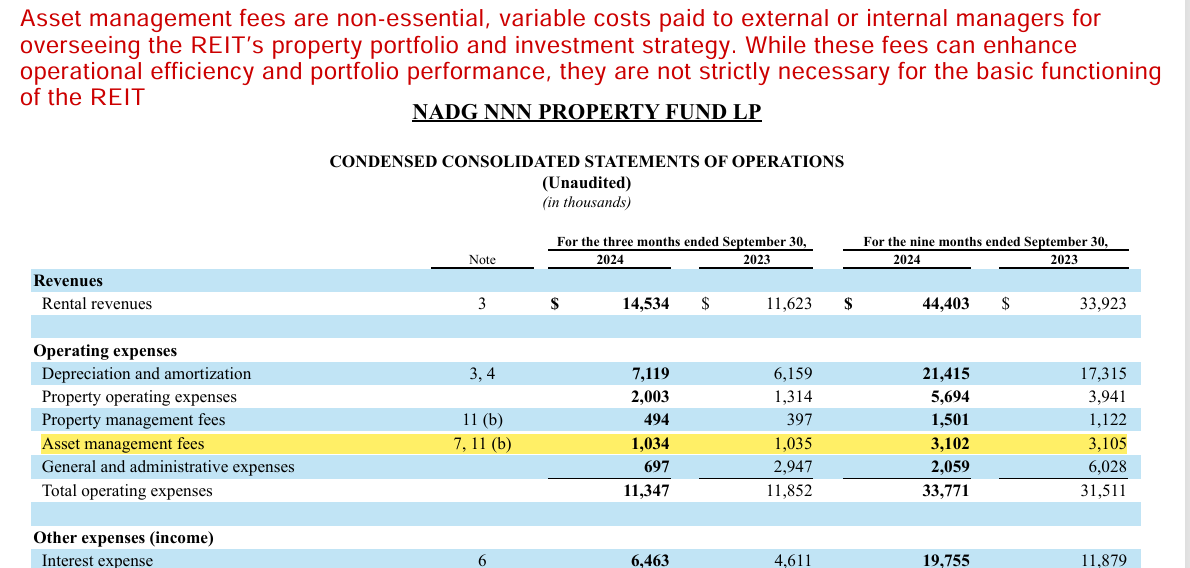

On the other hand, less essential costs may still be important but are not as critical to the REIT’s core operations. These include certain consulting fees, asset management fees, and discretionary expenses related to corporate strategy or growth initiatives. While they may contribute to efficiency and expansion, the company can adjust or reduce them if necessary without immediately affecting its core operations.

The following financial extracts from Front View REIT provide real-world examples of these cost structures.

One-Time vs. Recurring Costs

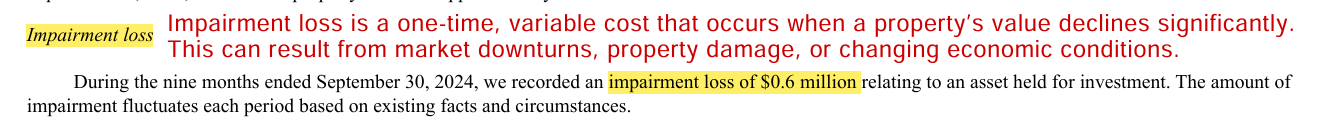

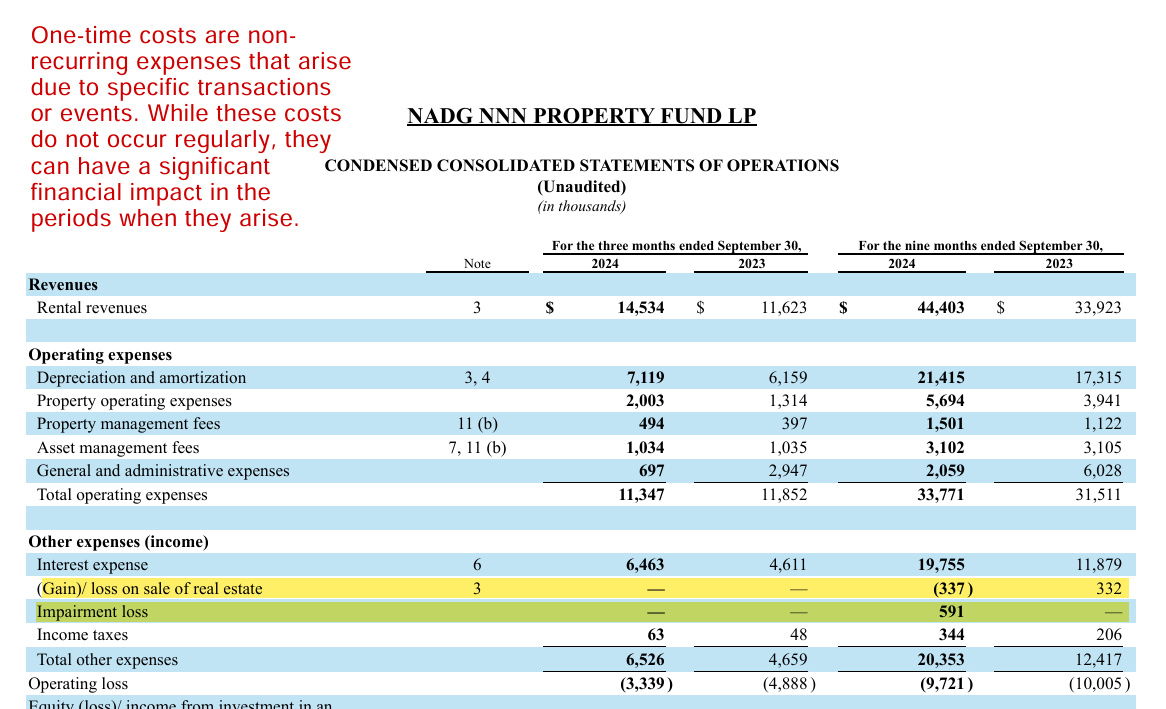

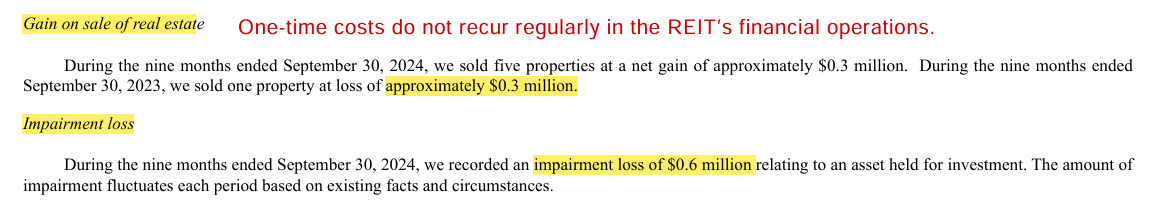

Some costs are one-time expenses, meaning they occur occasionally rather than on an ongoing basis. Examples include impairment costs (when a property loses value), legal fees related to major transactions, and costs associated with acquiring or selling real estate. Additionally, gains (or losses) on the sale of properties are transaction-based and do not happen regularly. These expenses typically depend on strategic decisions, market conditions, or external events.

The following financial extracts from Front View REIT provide real-world examples of these cost structures.

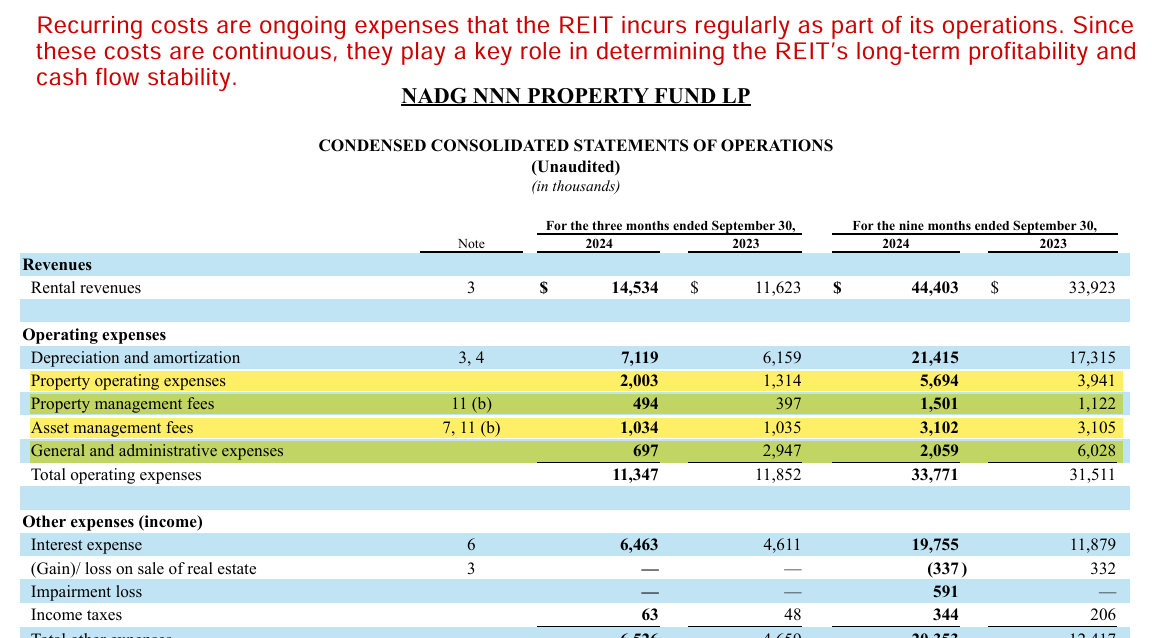

Other costs are recurring, meaning they occur regularly as part of the REIT’s ongoing operations. These include property operating expenses, property management fees, asset management fees, employee salaries and benefits, board compensation, insurance, and routine legal, audit, and tax expenses. These costs ensure that the REIT continues operating efficiently and generating income over time.

The following financial extracts from Front View REIT provide real-world examples of these cost structures.

Conclusion: Why Cost Analysis Matters in REIT Evaluation

Understanding a REIT’s cost structure is essential for assessing its profitability and long-term sustainability. By categorizing expenses into fixed vs. variable, essential vs. non-essential, and one-time vs. recurring, investors can gain deeper insights into the REIT’s financial health. Analyzing these costs allows investors to identify potential risks, evaluate operational efficiency, and make informed investment decisions in the real estate market.